Traditionally, there’s been a perception that young Australians want to live in our capital cities, thanks to the career opportunities, buzzing nightlife and vibrant lifestyle.

But new data from the Commonwealth Bank and the Regional Australia Institute’s Regional Movers Index has turned that notion on its head.

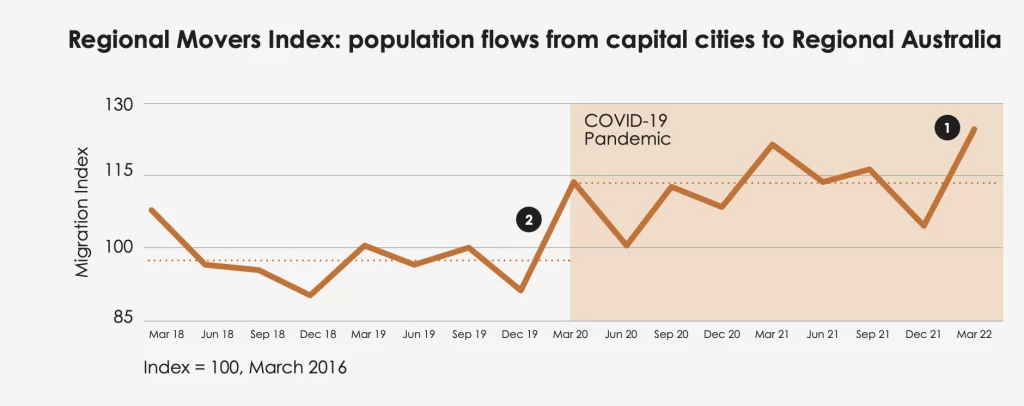

The index found that migration from capital cities to regional Australia increased by 16.6% over the 12 months to March, a five-year high – as the graph below shows.

But here’s where it gets interesting. That’s because it isn’t retirees leading the charge, but rather millennials – or those Australians born between 1981 and 1996.

And while the pandemic has undoubtedly been a push factor for this population shift, something else is clearly going on as the number of people moving from capitals over the

March quarter was 9% higher than the post-pandemic average.

So what is it?

To answer that question, you need to first look at where people are moving to:

- Ceduna (SA) = +114% annual growth in migration

- Mount Gambier (SA) = +85%

- Port Augusta (SA) = +74%

- Moorabool (Vic) = +56%

- Western Downs (QLD) = +56%

While the towns are very different, one thing unites them: housing affordability.

Take Ceduna, where the median asking price for a home at the beginning of July was $282,000, according to SQM Research. That’s nearly $500,000 cheaper than the national median dwelling price.

Not only can regional Australia offer more living space at a lower cost than the capital cities, but many regional locations are thriving. There were a record-high 86,000 unfilled positions in May 2022, nearly a quarter more than a year earlier.

Moreover, location is no longer a barrier to employment, thanks to the rise of remote work over the pandemic.

Federal government help available for regional first home buyers

Unaffordable housing might be driving some millennials from the city.

But getting a foot on the property ladder can still be challenging in the country, with saving a 20% home loan deposit one of the main obstacles. So it’s great news that the new federal government is rolling out a new initiative to help regional first home buyers tackle the deposit hurdle.

Under the Regional First Home Buyer Support Scheme, the federal government will guarantee up to 15% of a regional property’s value to 10,000 eligible first home buyers per year. As a result, they will be able to buy a home with a deposit of as little as 5% while avoiding paying lenders’ mortgage insurance.

The scheme will start in January 2023.

Looking to break into the property market? NMC Finance is an experienced home loan mortgage broker and can help you get on the ladder. Contact Nathan Coad on 0498 766 639 or nathan.coad@nmcfinance.com.au to find out more.

* This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.