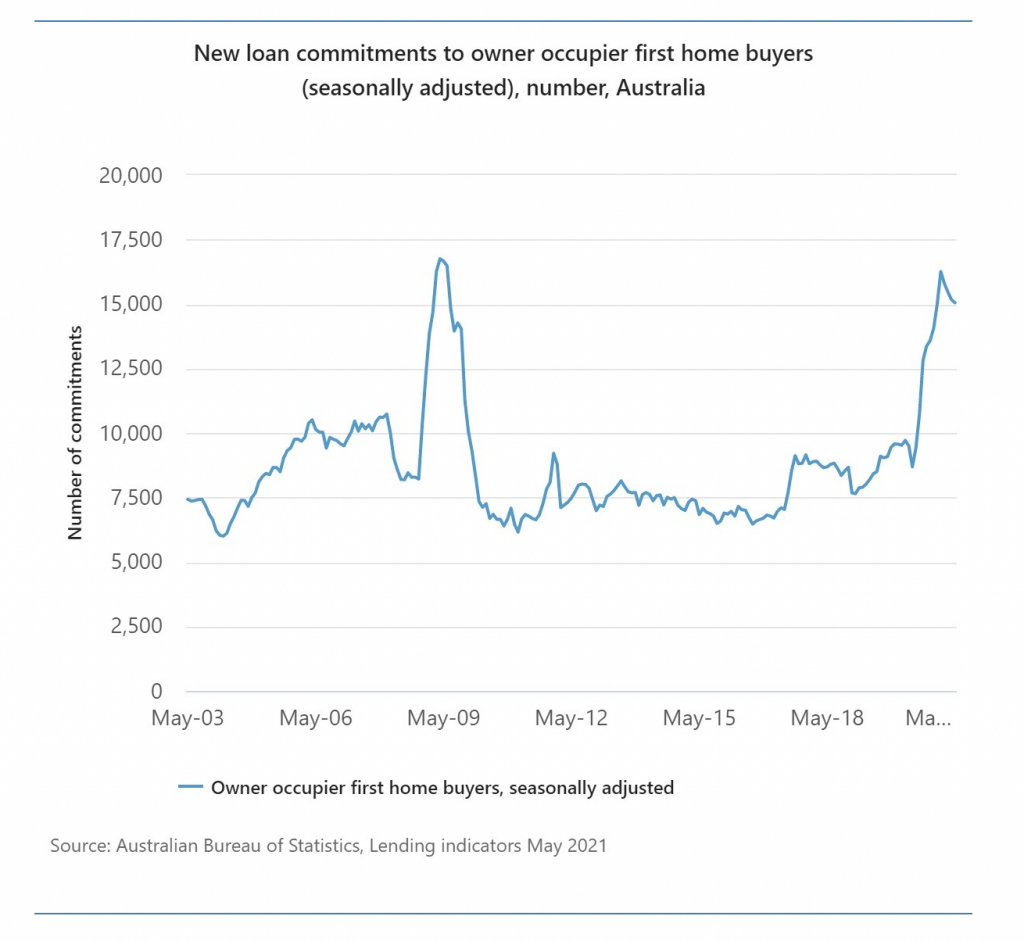

First home buyer activity is almost at record levels.

Why? Because now is a very good time to be a first home buyer.

Interest rates have never been lower. State governments are offering grants and stamp duty concessions. And the federal government has three schemes to help first home buyers:

- First Home Loan Deposit Scheme

- New Home Guarantee

- First Home Super Saver Scheme

But these good times won’t last forever. And, indeed, they may already be coming to an end.

Property prices are surging, making it harder for first home buyers to save a deposit.

Also, investors are pushing back into the market, which means more competition. Investor home loan activity in May (the most recent month for which the Australian Bureau of Statistics has data) was 13.3% higher than the month before.

So if you’re an aspiring first home buyer and you’re in a position to buy – you might want to move fast.

Want to get your foot on the property ladder? I can show you how. Contact me on 0498 766 639 or nathan.coad@nmcfinance.com.au to discuss your options.

* This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.