Home loan interest rates are on the rise, thanks to back-to-back cash rate hikes from the Reserve Bank of Australia that have seen the country’s official interest rate jump to 0.85%.

The RBA’s move comes off the back of the fastest acceleration of inflation in over two decades, representing a cost-of-living double-whammy for many Australian households.

But, as RBA governor Philip Lowe explained in his monetary policy decision statement, the hikes were necessary to bring ‘core’ inflation (currently 3.7%) back to its target range of between 2-3%.

As such, Dr Lowe flagged additional rises for the months ahead, with economists at the major banks all predicting a cash rate that starts with a ‘2’ by Christmas.

Whenever the RBA lifts the cash rate, most lenders pass this on in full to their existing variable-rate house loan borrowers – as occurred following the May and June increases.

A higher interest rate will mean larger mortgage loan repayments – with the average homeowner with a $500,000 debt seeing their home finance repayments increase by $511 per month if the cash rate hits 2%.

Competition in Australia’s mortgage market is alive and kicking

Your interest rate is one of the biggest factors affecting your home loan costs. So the higher it is, the greater your mortgage loan repayments.

But interest rates aren’t set in stone, with several factors impacting your mortgage’s interest rate. These factors differ from lender to lender, but are typically based on how much of a risk you represent as a borrower, and include your:

- Loan-to-value ratio

- Credit score

- Mortgage size

Now here is where it gets interesting.

Mortgage lenders set a ‘standard variable rate’ – or SVR – which is the general rate on offer to all their clientele. But Australia’s home loan marketplace is incredibly competitive, with lenders vying hard for new business. So, in an aggressive bid for new borrowers, many institutions then offer tempting discounts on the SVR to new mortgage sign-ups.

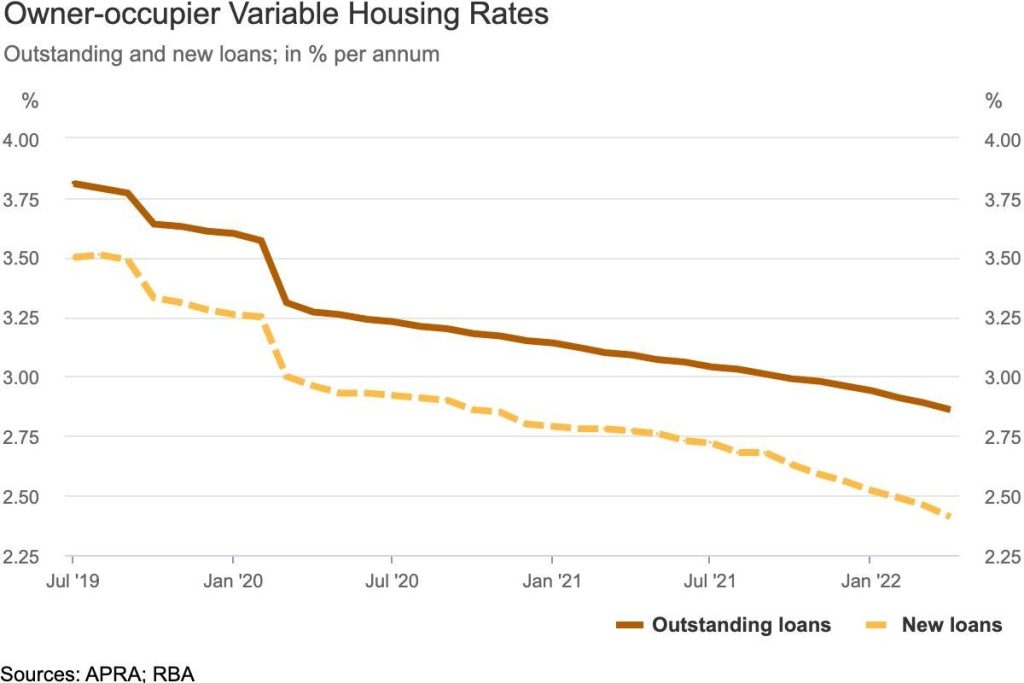

As the RBA graph below shows, the ‘pricing gap’ – i.e the difference between what existing customers and new customers get charged – was 0.45 percentage points in April.

Effectively, loyal customers get hit hardest by rate rises while new customers get better deals – which doesn’t seem very fair, right?

Thankfully, you don’t have to take it lying down as variable-rate home loans are some of the most competitive interest rates on the market currently.

So if you are prepared to refinance or renegotiate with your existing home loan lender, then you can take advantage of these sharp discounts. That way, you can get ahead of future rate rises.

What should you do now?

Refinancing isn’t suitable for everyone, and it does come with costs involved. So it’s often a good idea to review your financial circumstances with an experienced home loan broker like NMC Finance.

Your mortgage broker can help you compare other lenders’ offerings with your own mortgage, to make sure you are on the best deal possible for your situation. If you’re not, they can then help you take action.

Want to get ahead of rate rises? NMC Finance is an experienced home loan mortgage broker and can help you refinance. Contact Nathan Coad on 0498 766 639 or nathan.coad@nmcfinance.com.au to find out more.

*This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.