The Reserve Bank of Australia might have raised the cash rate by 250 basis points since May to 2.60% – the quickest tightening in nearly three decades – but a senior central bank official has claimed higher interest rates could ultimately benefit new homebuyers.

In a recent speech, Jonathan Kearns, the RBA’s head of domestic markets, explained why.

To begin with, Mr Kearns discussed how interest rates impact borrowing capacity – which is the maximum amount of money you can borrow for home finance based on your individual financial situation,

“A lot of media attention is placed on the increase in existing borrowers’ repayments when interest rates increase. But higher interest rates also reduce the maximum loan size for prospective borrowers looking to purchase housing,” Mr Kearns said.

This reduction in borrowing power doesn’t just come about because mortgages with higher interest rates are more expensive to repay back. It’s also because home loan lenders want to make sure you can still afford to repay the mortgage if interest rates increase in the future. So mortgage lenders assess your repayment capacity at an interest rate of at least three percentage points higher than the current rate on the house loan you’re applying for.

This is known as a serviceability buffer.

Mr Kearns said the RBA’s increases to the cash rate will have reduced the average borrower’s maximum loan size by about 20%.

“And because the assessment rate also applies to any existing debt, the decrease in borrowing capacity is even larger for prospective borrowers who have existing debt, such as property investors,” he said.

How does this benefit Australians looking to buy a new home?

Well, to understand that, you need to look at the impact of rising interest rates on property prices.

Higher Interest rates and property prices

Because rising interest rates increase the cost of paying back a mortgage loan, they typically reduce the demand for new home loan lending.

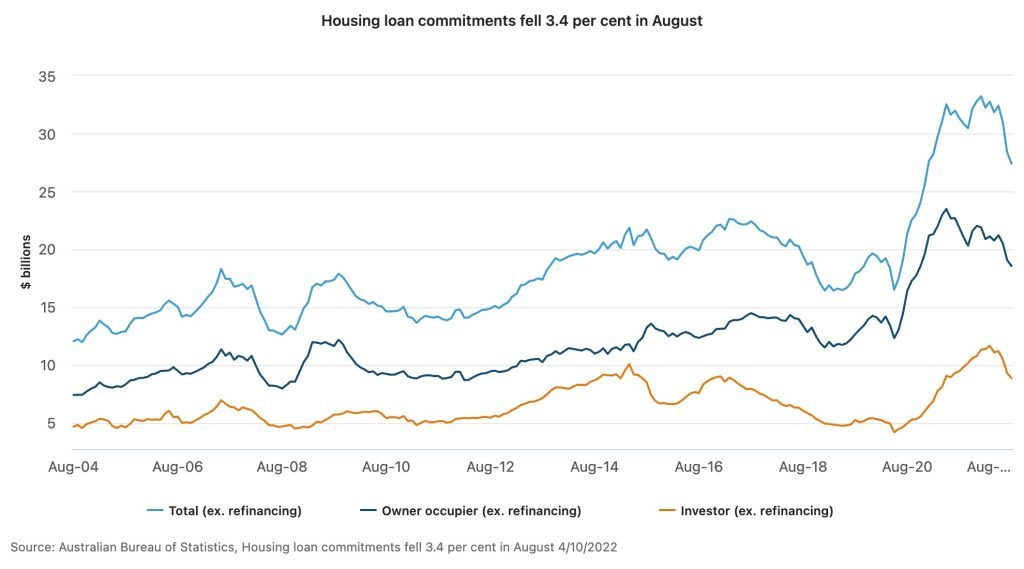

You can clearly see this dynamic playing out in recent Australian Bureau of Statistics lending data, which shows the value of new mortgages has fallen every month since May (when the RBA began raising the cash rate).

In turn, this then depresses home prices as it reduces demand for property.

Mr Kearns said, over time, the decline in demand for housing and, therefore, housing prices caused by higher interest rates means a household would need a smaller mortgage to buy a first home or upgrade. So, ultimately, new home buyers would have lower home loan payments than they would otherwise face.

“Estimates suggest the net effect is that mortgage payments for new buyers would be higher for about two years as a result of higher interest rates. But after that, the declines in housing prices and mortgage size begin to dominate,” he said.

“This exercise obviously abstracts from the many other factors influencing interest rates and housing prices, but it suggests that because higher interest rates reduce housing prices and so mortgage sizes, mortgage payments for new borrowers could ultimately be lower than if interest rates had not increased.”

If you’re wondering, “who’s the best mortgage broker near me?” NMC Finance is an experienced home loan broker who can help you get a great deal on a home loan. Contact Nathan Coad on 0498 766 639 or nathan.coad@nmcfinance.com.au to find out more.

* This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.