Melbourne property prices increased by another 1.3% in July, according to CoreLogic.

That latest rise takes the median value to $762,068 – 10.4% higher than the same time last year. However, there are signs the booming market is losing steam with the national monthly growth rate trending lower since March.

This ties in with recent data from the Australian Bureau of Statistics which shows the value of new home loan lending fell 1.6% in June, driven by a 2.5% drop in owner-occupier commitments.

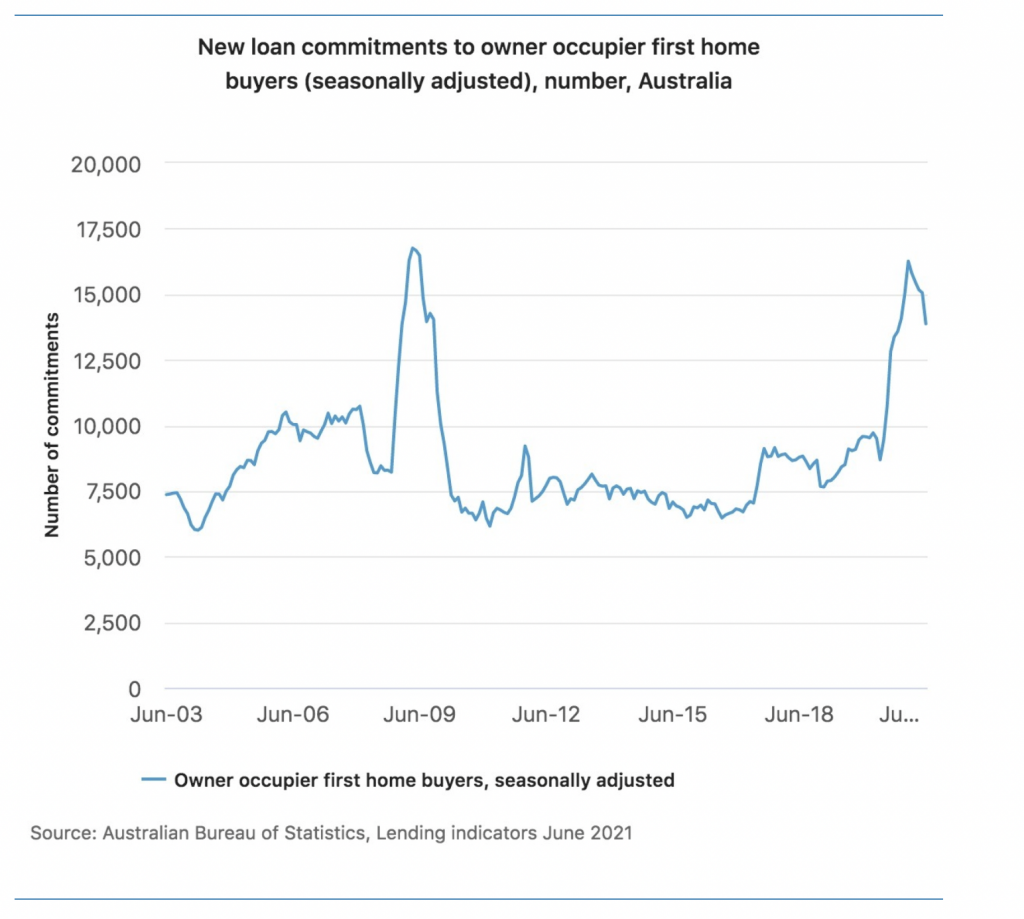

Owner-occupier first home buyer loan commitments also fell for the second month running, down 7.8% month-on-month. However, they still remain at historically elevated levels – similar to those seen in November 2020 (see image).

By value, first home buyer loan commitments accounted for 31.2% of all owner-occupier commitments in original terms, excluding refinancing, in June.

In Victoria, it’s a little higher at 34.7%.

Want to invest in commercial property? I can show you how. Contact me on 0498 766 639 or nathan.coad@nmcfinance.com.au to discuss your options.

* This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.