Property prices rose by an extraordinary 22.1% last year, according to CoreLogic, and many people are wondering if the boom will continue throughout 2022.

Nobody can ever say for certain what the future holds, but it’s highly unlikely prices will grow as quickly this year as they did the last. The price growth we experienced in 2021 was the third-highest in recorded Australian history (after 1950 and 1989), according to realestate.com.au, so it’s improbable we could have two such massive years in a row.

Late last year, the big four banks forecast how they expected property prices to move in 2022. Westpac forecast growth of 8%, Commonwealth Bank 7%, ANZ 6% and NAB 5%. The precise numbers are less important than the sentiment – that while prices will still increase in 2022, the growth will be significantly slower than in 2021.

It’s also worth remembering that prices can’t keep going up forever. Although prices are likely to keep rising over the decades ahead, markets never rise in a straight line: there are periods when prices go down and periods where they flatline. So, at some point, this particular cycle of growth will come to an end. It might be this year, it might be next year, it might be a different year; but, sooner or later, it will happen.

Why prices are likely to keep rising in 2022

Before we discuss why many economists expect price growth in 2022 to be slower than in 2021, let’s discuss the three main reasons why prices are still likely to rise this year.

First, demand remains high. As the graph shows, the average number of people viewing each for-sale listing on realestate.com.au has been trending up. The most recent data, for December, shows that average views were:

- 32.7% higher year-on-year for all listings in Australia

- 16.0% higher year-on-year for all listings in Victoria

This strong demand is being driven by ultra-low interest rates, which make it relatively easy to service a mortgage. It’s also being driven by FOMO – people are afraid of missing out on the price gains being enjoyed by home-owners right now.

The second reason prices are likely to rise in 2022 is because while demand is high, supply is low. Predictably, the number of properties listed for sale fell between November and December, according to SQM Research. However, as the chart shows, listings in December 2021 were significantly lower than in December 2020 – 20.0% lower across the country and 12.0% lower in Melbourne.

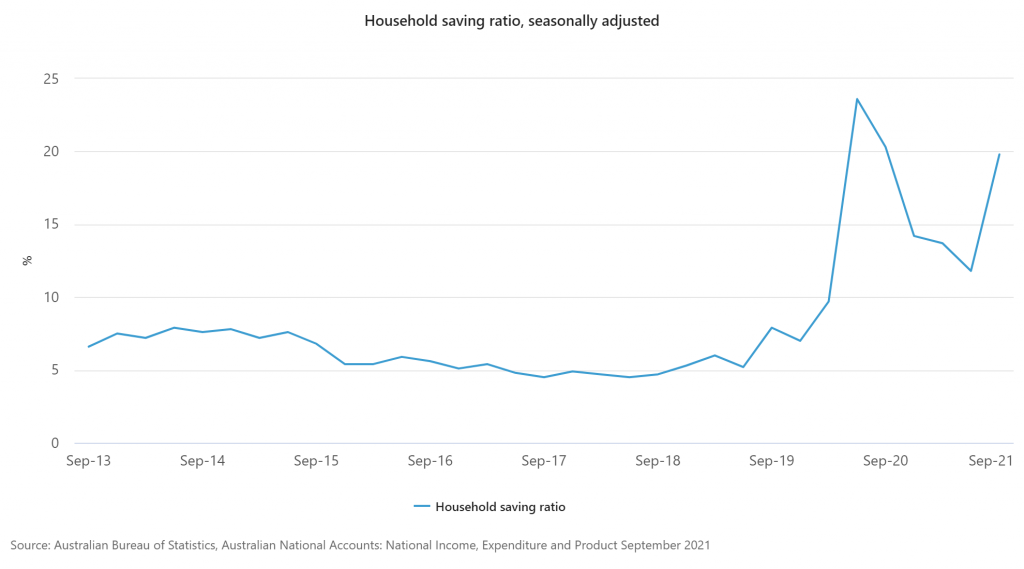

The third reason prices are likely to rise this year is because Australians are cashed up. The average household saved a large 19.8% of its income in the September quarter, according to the most recent data from the Australian Bureau of Statistics. That savings rate is very high by historical standards and means a lot of people have the funds required to buy property.

Why price growth in 2022 is likely to be slower than in 2021

That said, there are two main reasons why price growth is likely to slow.

First, while property prices grew 22.1% last year, the salary of the average Australian is growing by only 2.2% per year right now, according to the Australian Bureau of Statistics. That means fewer people can now keep bidding up prices, which in turn will put downward pressure on demand.

Second, while the number of total listings is low, the number of new listings is rising. As the chart from SQM Research shows, the number of new listings added to the Australian property market in December 2021 was 2.4% higher than the year before (although it was 6.0% lower in Melbourne). Increased supply will also put downward pressure on demand.

Want to buy a property in 2022? NMC Finance is an experienced mortgage broker and can help you get home finance, whether you’re a first home buyer, an upgrader, a downsizer or an investor. If you want to discuss your options with an experienced finance broker, contact Nathan Coad on 0498 766 639 or nathan.coad@nmcfinance.com.au.

* This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.