Spring is in the air. Alongside the warmer weather comes what is traditionally the busiest season of the year for Australia’s property markets, with listings numbers and buyer activity usually significantly higher than during the winter months.

This spring season will be very different from the previous two years, with no lockdowns or restrictions in sight. But the Reserve Bank of Australia’s rapid-fire interest rate hikes are starting to bite – with property prices, sales volumes and auction clearance rates all falling in many parts of the country.

So you might be wondering: should you buy property in a falling market, or is it better to wait?

The property market is your oyster.

You might be nervous about buying a home in a falling market, given that whatever property you buy today might be worth less the day after.

But now is actually a great time to be a buyer. That’s because with property listing numbers rising, buyer competition falling and homes taking longer to sell, vendors are having to price their properties more realistically and be willing to entertain discounts.

As the charts below show, in the three months to August, the median vendor discount at the national level was 4.0%, according to CoreLogic – a big bump on the recent low of 2.8% recorded in the three months to April last year.

So buyers are clearly gaining the upper hand from sellers. As a result, now could actually be a great time to be in the market for a new home – especially in comparison to last year.

Property is a long game.

But wait … doesn’t this mean that it’s better to bide your time so you can ‘buy the dip’ and get a better deal?

That’s generally a bad idea for two big reasons.

Firstly, none of us has a crystal ball, so no one can know when the market will bottom out. Indeed, it might have already bottomed out for all we know. You only discover several months after the fact, once the data has been collected and trends have become clear.

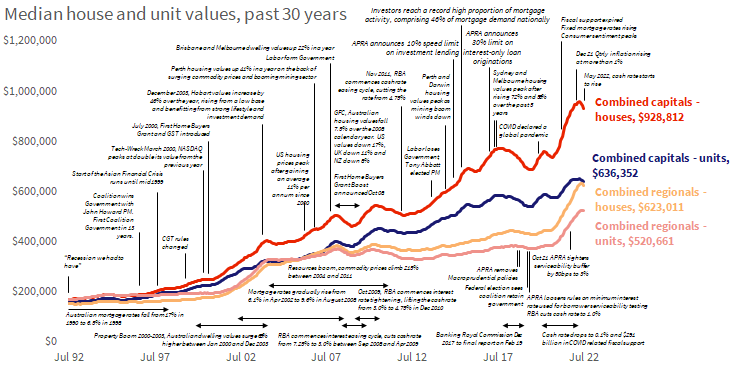

Secondly, history tells us Australian property is remarkably resilient to the occasional downswing – with national median property values increasing by 382% over the past 30 years, according to CoreLogic. During this time, there have been six downturns (including the current one).

So it’s generally better to focus your efforts on buying a quality property than worrying about what the market will be doing in a few months.

Your borrowing power is shrinking.

One final point to remember.

Every time the Reserve Bank of Australia raises interest rates, the maximum amount of money you can borrow for a home loan falls.

With the RBA signalling, more rates are likely; you might not want to wait too long as this could erode your borrowing capacity further.

Looking to buy a property? NMC Finance is an experienced home loan mortgage broker and can help you with home loan finance. Contact Nathan Coad on 0498 766 639 or nathan.coad@nmcfinance.com.au to find out more.

* This blog is intended for general informational purposes only. For personalised advice tailored to your unique financial situation, please contact NMC Finance.